TRUMP'S CORRUPTION; PANDORA PAPERS COMPARED WITH INFLUENTIAL FILIPINOS

A series of reports from the New York Times about how Donald Trump's son-in-law and advisor Jared Kushner, and Trump Treasury Secretary Steve Mnuchin, used their positions in the U.S. government to develop relationships with foreign governments, and then made massive private financial deals with those governments once Trump was out of office. »

WASHINGTON, DC - JULY 24: White House Senior Advisor and President Donald Trump's son-in-law Jared Kushner reads a statment in front of West Wing of the White House after testifying behind closed doors to the Senate Intelligence Committee about Russian meddling in the 2016 presidential election at the White House July 24, 2017 in Washington, DC. In a statement released before the meeting, Kushner said he met with people who represented or may have represented the Russian government four times. (Photo by Mark Wilson/Getty Images)MARK WILSON

Back in April, The New York Times reported that Jared Kushner’s four years of Saudi ass-kissing and murder-excusing had paid off in the form of a $2 billion investment from the kingdom‘s sovereign wealth fund to his newly formed private equity firm. That struck a lot of people—ethics officials among them—as pretty shady given that far from having impressed would-be clients with his investing prowess, the panel that performs due diligence for the Saudi fund concluded that no one in their right mind would give the former first son-in-law a dime. Among other concerns, the panel noted that management was “inexperience[d],” that the kingdom would be responsible for “the bulk of the investment and risk,” that its fee seemed “excessive,” and that the firm’s operations were “unsatisfactory in all aspects.” Given those reservations, it warned that the country’s Public Investment Fund should stay far, far away from Kushner’s firm—a recommendation that was overturned by the fund’s board, which happens to be led by Crown Prince Mohammed bin Salman, i.e., the guy who approved a plan to kidnap, kill, and dismember a journalist via bone saw and benefited from Kushner’s unwavering support within the White House and reported insistence that the prince could “survive the outrage just as he [had] weathered past criticism.” (Again, just so it‘s abundantly clear, the “outrage” and “criticism” were over a Saudi dissident and U.S. resident being chopped up into pieces.)

So, it wasn’t that difficult for people to put two and two together and infer that Kushner’s firm seemingly got $2 billion to invest—and at least $25 million to pocket regardless of performance!—as a thank-you for being so good to a human rights-abusing autocrat. And a new story from the Times suggests, somehow, even further shadiness than that.

The paper’s Kate Kelly and David Kirkpatrick report that “shortly before the 2020 election,” Kushner unveiled a government-sponsored program dubbed the Abraham Fund, which the Trump administration said would raise $3 billion for projects around the Middle East, capitalizing on the Abraham Accords, the diplomatic agreements normalizing relations between Israel, the United Arab Emirates, and Bahrain. As part of that endeavor, Kushner and then Treasury secretary Steven Mnuchin “crisscrossed the Middle East in the final months of the administration on trips that included trying to raise money for the project.”

PROFILES: Filipino tycoons, government officials in Pandora Papers leak

MANILA, PHILIPPINES

(1st UPDATE) Explore the offshore financial dealings of Arthur Tugade, Dennis Uy, and other Philippine power players in the Pandora Papers

(Done in partnership with the International Consortium of Investigative Journalists)

This page, produced by Rappler and the Philippine Center for Investigative Journalism (PCIJ), features the offshore companies linked to more than 35 Filipino politicians, contractors, bankers, and business professionals.

Their profiles are based on a cache of leaked documents from offshore service providers, namely, Trident Trust, Commence Overseas Limited, Overseas Management Company Trust Limited, Asiaciti Trust, and Alcogal.

The documents were shared with Rappler and PCIJ by the non-profit International Consortium of Investigative Journalists (ICIJ), which led a global investigation with more than 600 journalists in 117 countries.

PCIJ and Rappler found more than 940 individuals and companies with Philippine addresses in the leaked files.

We sifted through hundreds of emails, documents and corporate records, and selected names that were in the public interest.

We found an extremely small number of accounts are tied to big businesses with legitimate sources, while the rest are mysterious at the very least.

There are legitimate uses of offshore companies, and we do not intend to imply that all of the individuals or companies included in this page were in violation of the law.

PCIJ and Rappler sent requests for comment to all those on the list. The answers we received are included in the profiles.

Arthur Tugade

Arthur P. Tugade is the Philippines’ transport secretary under the Duterte government. Before that, he was president of the Clark Development Corp. under the Aquino administration.

IN THE DATA:

Tugade and his children appear in Trident Trust records as beneficial owners of Solart Holdings Limited, a British Virgin Islands (BVI) company which appears to have been operating at least since 2007.

The offshore company was supposedly created for the income of the Tugade family’s businesses under Perry’s Group of Companies, Trident records show. Company assets worth $1.5 million (P75 million) were mentioned, but it is unknown whether the amount was transferred to Solart.

The offshore entity is not declared in the list of businesses in his yearly Statement of Assets, Liabilities and Net Worth.

RESPONSE:

On October 5, 2021, a day after the Pandora Papers were published, Tugade issued a statement, saying that Solart Holdings was set up to hold a portion of his family’s cash assets.

“It is a legitimate attempt to grow our financial portfolio like what any astute and judicious entrepreneurs would do to diversify their investments. We decided to have a portion of our savings invested outside the Philippines, which is valid and legal,” he said.

Tugade said he consistently disclosed ownership of “offshore investments” in his SALN from 2012 to 2020. “In the said period, the account barely moved,” the transport chief said.

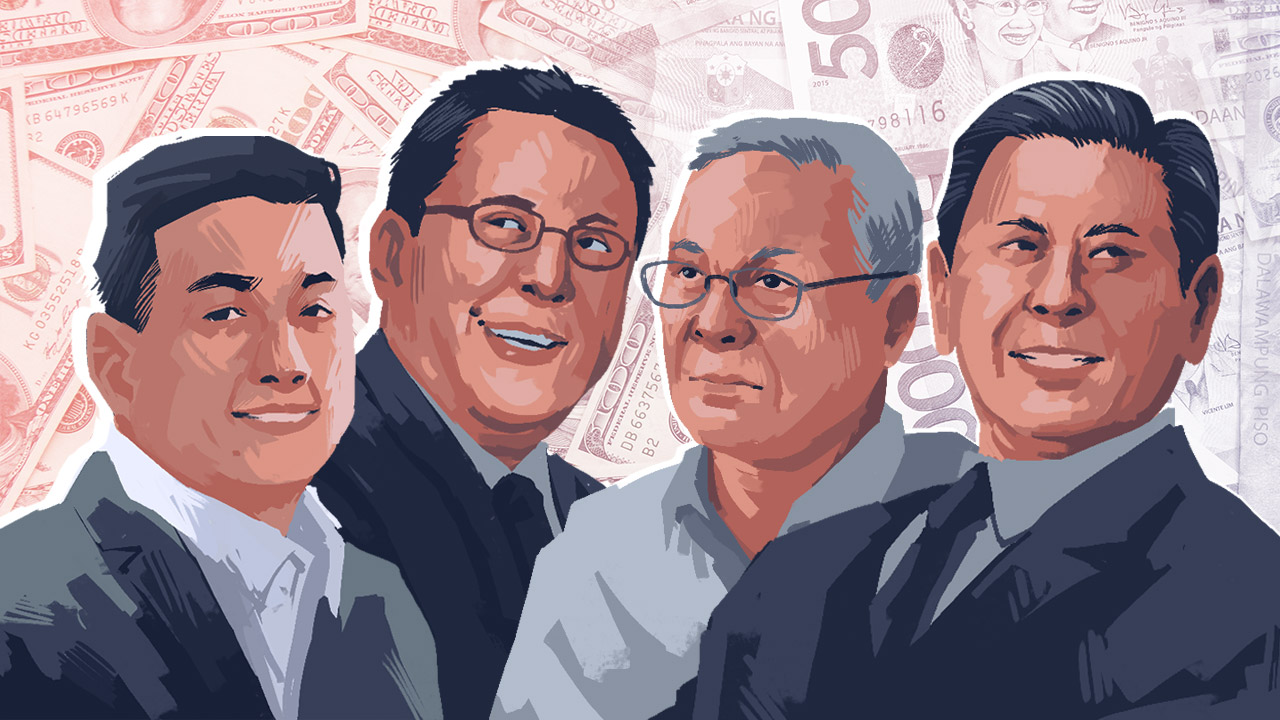

Dennis Uy

Dennis Uy is a businessman with interests in shipping and logistics, gas distribution, telecommunications and other industries. Uy donated P30 million to Rodrigo R. Duterte’s presidential campaign in 2016 and was later appointed presidential adviser for sports. He has also been serving as honorary consul to Kazakhstan since 2011.

IN THE DATA:

Uy appears in Commence Overseas Limited records as the beneficial owner of China Shipbuilding and Exports Corp., a British Virgin Islands (BVI) company registered in 2016.

He is also listed as director of Pacific Rider Limited in Overseas Management Company (OMC) Trust Limited records. Pacific Rider is another BVI company registered in January 2017. Uy’s company, Udenna Management and Resources Corp., is identified as the principal shareholder of Pacific Rider.

Uy is also a stockholder of Apex Mining Co., Inc, a Philippine corporation that ultimately holds Monte Oro Mining Co. Ltd., another BVI company managed through Commence.

In the prospectus of one of Uy’s companies, Chelsea Logistics and Holdings Corp., which was published before its initial public offering, the company declared that Chelsea purchased three tank vessels from China Shipbuilding and Exports Corp. (CSEC), one each in 2011, 2013, and 2014. The collective cost of the three vessels is $48.3 million. Chelsea disclosures did not indicate that CSEC is also owned by Uy.

RESPONSE:

PCIJ and Rappler sent a letter to Mr. Uy on September 16 via email and made several followups. We have not received a response as of press time.

Juan Andres ‘Andy’ Bautista

Juan Andres “Andy” Bautista served the administration of President Benigno Aquino III in two capacities.

He was appointed as chairman of the Presidential Commission on Good Government in 2010 and chairman of the Commission of Elections in 2015. The House of Representatives started an impeachment proceeding against Bautista in 2017, following allegations of unexplained wealth by his estranged wife. Bautista resigned from Comelec in October 2017.

Before his stint in government, he served in various law firms, including Anglo Oriental Consulting Ltd. (Manila), White & Case (Hong Kong/New York), Troutman Sanders (Atlanta), and Castillo Laman Tan & Pantaleon (Manila). He was also a partner with international law firm Allen & Overy.

IN THE DATA:

Bautista appears in Trident Trust records as incorporator of Baumann Enterprises Limited, a company registered in the British Virgin Islands in 2010. The offshore company was reincorporated in 2017.

In the same year, Bautista was in hot water after his estranged wife, Patricia Paz Bautista, claimed he had a boxful of bank books and documents for undeclared wealth worth P1 billion. Baumann was one of the companies mentioned by Patricia to the press as a firm owned by her husband.

Before the year ended, Bautista had resigned from his post as Comelec chair, and left the Philippines. Baumann has never been declared in Bautista’s Statement of Liabilities, Assets and Net Worth (SALN) from 2010 to 2015.

RESPONSE:

In an email, Bautista said Baumann Enterprises is a shelf company his family purchased upon the advice of the Bank of Singapore (BOS), the institution in charge of the offshore income of the Bautista family through private banking.

“We were told this was normal private banking practice to facilitate our family’s desired objective of pooling our assets together,” he said.

The former Comelec chairman also noted he and his other family members had not directly dealt with Trident. He also reiterated that his personal assets in the company “were reported and duly reflected” in his SALNs.

However, Bauman has never been declared as his in his SALNs from 2010 to 2015.

Still, he contends he had not stolen any public funds from the Philippine government, “nor do I possess any ill-gotten wealth.”

Aboitiz family

The Aboitiz family owns one of the oldest conglomerates in the Philippines, the Aboitiz Group. It was founded by Filipino-Spanish businessman Jon Ramon M. Aboitiz in the 1970s. The conglomerate has interests in power generation, banking, real estate and infrastructure.

IN THE DATA:

Pandora Papers show several members of the Aboitiz family as having offshore companies, but only one has been mentioned publicly to be used for business purposes: Nice Fruit Hong Kong Ltd., a company registered in Hong Kong. Asiaciti Trust records show that 14% of the company’s shares is owned by Txanton International Limited, a British Virgin Islands (BVI) company. It is in turn, indirectly owned by Enrique Mendieta Aboitiz, current board chairman of Aboitiz Equity Ventures, as his trust in the firm is held by an individual named Leung Yi Ki. Nice Fruit, a joint venture with Del Monte Pacific Limited, and listed by the latter in its annual reports as such.

Enrique has three other BVI companies as revealed in Alcogal records: Arcata Group Limited, All Venus Limited, and Radiant Magic Limited. He also has two Seychelles companies: Permanent Victory Limited and Cloud Victory Limited.

Meanwhile, Maria Cristina Cabbarus Aboitiz, who is a current board member of the Ramon Aboitiz Foundation Inc., and wife of the late Robert Aboitiz, appears in the AsiaCiti Trust records as the beneficial owners of Woodcrest Hill Limited and Stillcho Trust.

Trident Trust records also show Melissa Marie Aboitiz Elizalde as the beneficial owner of Ozmond Holdings Limited and Santdomico Corporation. She is among the top 100 shareholders of Aboitiz Power Corp., a listed firm in the Philippines.

She also co-owns Igsoon Investment Limited with her siblings, Luis Miguel Osmena Aboitiz, the former chief strategy officer of Aboitiz Power, and Mary Anne Aboitiz Arculli.

RESPONSE:

PCIJ and Rappler sent a letter to the Aboitiz family on September 16 via email and made several followups. We have not received a response as of press time.

Gaisano family

The Gaisano family owns the publicly-listed Metro Retail Stores Group and the private mall operator Gaisano Grand Malls Group.

IN THE DATA:

Siblings Frank, Edward, Jack, and Margaret Gaisano appear in the Commence Overseas Limited list as beneficial owners of Beacon-Glory Assets Limited, Cathedral Pacific Limited, Chinaberry Asia Limited, and Pura Group Limited.

RESPONSE:

Frank Gaisano, through their lawyers, said that the BVI companies were made “for offshore business opportunities.”

The Gaisano family chose to incorporate the companies outside of the Philippines “for cost and tax efficiency.”

“There is no Philippine law that requires Filipinos (those not working in the government) to declare to Philippine authorities the offshore companies that they own or invest in,” their statement read.

Gatchalian family

The Gatchalian family rose to prominence as operators of plastic manufacturing facilities under the Wellex Group Inc. (WGI). The Gatchalian patriarch, William T. Gatchalian, founded the firm in 1969.

For the past five decades, the family has expanded its interests to include real estate, tourism, banking, and mining.

In 2001, the second generation of Gatchalians, led by now-Senator Sherwin, joined the political arena. Sherwin served as representative of Valenzuela City in Congress from 2001 to 2004, then as mayor of the city from 2004 until 2013, then back as congressman for another term, before getting elected to the Senate in 2016. His brothers have held the mayoral and congressional seats since he vacated them.

These political developments happened as members of the Gatchalian family, including Sherwin, were indicted in 2016 for the government’s alleged irregular acquisition of an insolvent bank owned by WGI.

In 2019, the Local Water Utilities Administration acquired Express Savings Bank Inc., a local thrift bank based in Laguna, a province south of Metro Manila.

IN THE DATA:

Members of the Gatchalian family – namely, William and his wife, Dee Hua; his son, Kenneth; and Dee Hua’s sister, Elvira Ting – are linked to at least nine offshore companies, as shown in Commence Overseas Limited records.

William and Dee Hua are named as direct beneficiaries of Creston Global Limited. Dee Hua is also named as sole direct beneficiary of Topwin Ventures Limited and Dedication Limited. She co-owns Silver Green Investments Limited and Polymax Worldwide Limited with Elvira Ting as well.

Meanwhile, Kenneth is found to be a direct beneficiary of Dynamo Atlantic Limited, Pentagon Development Limited and Overjoy Holdings Limited. He also co-owns Firstlink Investments Limited with Elvira Ting. There are no details of when the companies were incorporated, except for Dedication Limited, which was revealed to have been registered in the British Virgin Islands in 1992.

Polymax Worldwide Limited is the only publicly declared entity. Metro Alliance Holdings Corp., a WGI subsidiary, incorporated the company in 2003, Metro Alliance annual reports show. Polymax was used to acquire the controversial Bataan Polyethelyne Corp. from International Finance Corp. in 2005.

BPC was debt-ridden when Metro Alliance acquired it. Metro Alliance also never got to operate the facility. Instead, Polymax sold its shares to Iran-based NPC International Limited and Petrochemical Industries Investment Group, to offload its liabilities.

RESPONSE:

Nikki Jimeno, the Gatchalian family’s legal counsel, said the offshore companies were incorporated for “legitimate investment purposes” as they would like to explore “global trading”.

Jimeno also noted stockholders of its companies were notified of the activity. Among the offshore companies found in the Pandora Papers, only Polymax Worldwide Limited were disclosed in the annual reports of Metro Alliance Holdings & Equities Corp.

Olivares and Santos families

The Olivares and Santos families own Our Lady of Fatima University, which has six campuses across the Philippines. The institution started from the establishment of Our Lady of Fatima Hospital in Valenzuela in 1967. By the next decade, they expanded and opened the Our Lady of Fatima College of Nursing. Since then the institution has opened campuses in different parts of Luzon.

IN THE DATA:

August Olivares Santos, executive vice president and chief financial officer of Our Lady of Fatima University, appears in Commence records as the beneficial owner of 7-21st Street Investments Inc., a company registered in the British Virgin Islands in 2008. A 2012 document shows that at least six relatives are also directors of the company. They are Enrico John Olivares Santos, Mylene Olivares Santos, Robert Jerome Bjorn Olivares Santos, Vicente Olivares Santos Jr., and Yvonne Olivares Santos. All of them are either current members or once served on the board of Our Lady of Fatima University.

August Olivares Santos also appears in Trident Trust and Commence Overseas records as director of two other offshore firms: Fairbrook Overseas Limited and Waterberry Management Limited, companies registered in the British Virgin Islands.

RESPONSE:

PCIJ and Rappler sent a letter to the Olivares and Santos families on September 16 via email, and made several followups. We have not received a response as of press time.

The Sy family

The Sy siblings – Henry, Hans, Harley, Elizabeth, Herbert, and Teresita – own the SM Group. Forbes ranked them as the richest Filipinos, collectively worth $16.6 billion.

IN THE DATA:

The names of Henry, Hans, Harley, Elizabeth, Herbert, and Teresita appear in the Commence Overseas Limited records as owners of Quicksilver Global Limited and Valueplus Resources Limited.

The list also states that Teresita and Harley are the beneficial owners of Deercreek Worldwide Limited.

Harley is also said to be the beneficial owner of Crownhill Overseas Limited, Equimax Worldwide Limited, Simplex Group Limited, Broadbase Global Limited, and Pioneer Zone Investments Limited.

Teresita is listed as the owner of Antares Resources Limited and Accura International Limited.

Harley and Teresita were also mentioned as owners of Jetstream Capital Limited.

RESPONSE:

PCIJ and Rappler sent a letter to the SM Group on September 20 via email, and made several followups. We have not received a response as of press time.

Tantoco family

The Tantoco family founded luxury retail chain Rustans and own the SSI Group, the Philippines’ largest specialty retailer.

IN THE DATA:

The names of SSI president and director Anthony Tantoco Huang and its CEO Zenaida Tantoco appear in the Commence Overseas Limited list as beneficial owners of Transwell Worldwide Limited and Eaglepass International Limited.

RESPONSE:

PCIJ and Rappler sent a letter to SSI on September 20 via email. We have not received a response as of press time.

Joselito ‘Butch’ Campos Jr.

Campos is the founder of food and condiments firm NutriAsia Inc. In 2006, the firm bought a majority stake in Singapore-based Del Monte Pacific Limited.

Campos also has interests in real estate and pharmaceuticals through his father’s businesses, Greenfield Development Corp. and Unilab Laboratories Inc. The food tycoon is known among the local art circle to be a collector. Campos chairs the Metropolitan Museum of Manila and the Bonifacio Arts Foundation Inc.

IN THE DATA:

Pandora Papers do not show Campos as a beneficial owner of any offshore firm, but he is revealed to have done business with one. In 2011 and 2015, Campos bought art pieces through Montefalco Limited, a Hong Kong-based offshore firm.

Asiaciti records reveal Montefalco facilitated Campos’ art purchases abroad. The two transactions, which at one point involved a purchase of a Fernando Amorsolo oil painting, were worth $150,000 and £160,000, respectively.

RESPONSE:

In an email, Antonio Ungson, internal legal counsel of Del Monte Pacific Limited, said Campos is “a private citizen and has purchased artworks only in his personal capacity.”

Ungson reiterated that Campos does not have beneficial interest in Montefalco Limited.

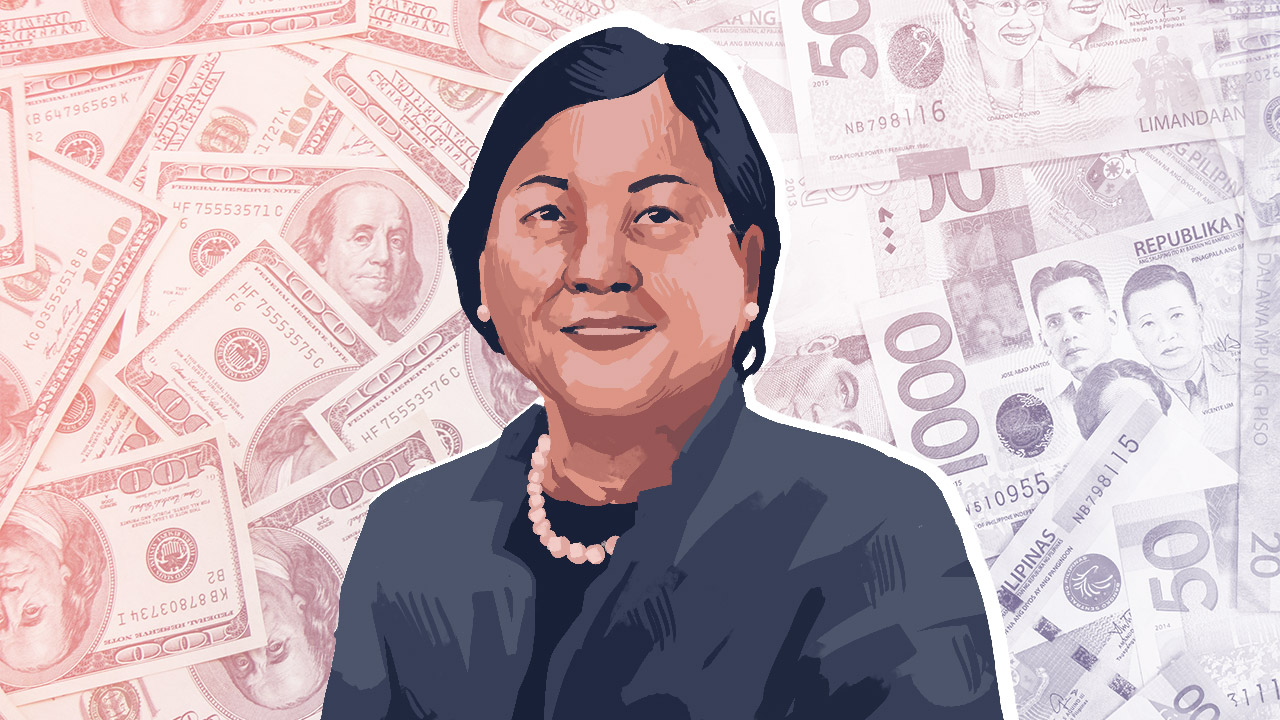

Helen Dee

Helen Dee is the chair of Rizal Commercial Banking Corporation (RCBC).

The bank was used by cyber criminals to steal $81 million from the Bangladesh Bank in February 2016.

IN THE DATA:

Helen Dee appears in Trident Trust records as the beneficial owner of Jason Holding Ltd. and Neenah Ltd., two companies registered in the British Virgin Islands in 1988 and 1994, respectively.

In April 2016, amid the Bangladesh Bank heist investigations, records show that Dee changed the agent in charge of these two companies, from Trident Trust to MMG Trust. There are no details on what the companies are being used for.

RESPONSE:

PCIJ and Rappler sent a letter to Ms. Dee on September 16, via email, and made several followups. We have not received a response as of press time.

Rolando Gapud

Rolando Gapud is the executive chairman of the board of Del Monte Pacific Limited.

He served as “financial adviser” to the Marcos family. He would later on help identify the family’s assets for government retrieval.

IN THE DATA:

Gapud appears in Asiaciti Trust records as the beneficial owner of Retiro II Trust (Cook Islands) and Northwick Holdings Limited (British Virgin Islands). His wife and six children were also identified as direct beneficiaries.

As of 2014, Northwick Holdings Limited owns 40% of a company called Great Arian Property Holdings Co. Inc. in the Philippines. Gapud had also disclosed in Asiaciti Trust records that Retiro II Trust would comprise of “properties held in the Philippines by BVI companies which he owns and administers personally.” The communication was made in 2014. In the same year, Gapud was named as chairman of Del Monte Foods Inc.

RESPONSE:

In an email, he said “the trust and Northwick Holdings were formed upon the advice of our lawyers for estate planning purposes.”

Gapud noted the trust and Northwick were never activated and have remained dormant.

“No assets were ever added to the trust or Northwick,” he added.

Oscar Hilado

Oscar Hilado is director of several companies with interests in telecommunications, tourism and mining. He is chair of publicly listed firm Phinma Corp. since 2003. In 2015, he became an independent director of Rockwell Land Corp.

IN THE DATA:

Hilado appears in Commence records as the beneficial owner of Merrylink International Limited, a company registered in the British Virgin Islands.

RESPONSE:

Hilado said the company was established as part of an investment portfolio plan “that was ultimately not pursued.” He said the company is now closed.

Enrique Razon Jr.

Enrique Razon Jr., chairman of International Container Terminal Services, the country's leading terminal operator, has been on in Forbes’ list of 10 richest Filipinos since 2011.

In the past decade, Razon has expanded to hospitality and infrastructure business, through Bloomberry Resorts and Prime Infrastructure Holdings, respectively. He also has business interests in water distribution, retail, and mining.

Razon has bagged key infrastructure projects in the past five years. Razon’s infrastructure firm, Prime Infra, got a water dam project and the rights to distribute electricity in a provincial island town in the Philippines.

Recently, Razon was allowed to build a mega vaccination site on reclaimed land in Metro Manila.

IN THE DATA:

Razon appears in 2016 Commence Overseas Limited records as the beneficial owner Monte Oro Mining Co Ltd. (MOMCL), a company registered in the British Virgin Islands.

Apex Mining Co Inc., a mining company registered in the Philippines, indicated in its annual reports that MOMCL is a subsidiary of Monte Oro Resources & Energy, Inc. (MORE).

MOMCL was incorporated in 2016, and lists the Filipino billionaire as a direct beneficiary.

Razon owns 40% of the shares of Apex Mining Co Inc. Apex annual reports also show that MOMCL owns a gold mining project in the Republic of Sierra Leone in West Africa.

Aside from MOMCL, Razon also appears in Commence records as a direct beneficiary of Saxony Asia Limited, a company registered in 2016.

RESPONSE:

PCIJ and Rappler sent a letter to Mr. Razon on September 16 via email. We have not received a response as of press time.

Peter Rodriguez

Peter Rodriguez is the founder of Asian Aerospace Corp., an air charter operator. The company is considered a pioneer in the local industry.

In 2001, Asian Aerospace Corp. partnered with U.S.-based arms and defense firm Lockheed Martin Corp. for a P2.1-billion deal with the Armed Forces of the Philippines.

PCIJ reported Lockheed was looking to sell military planes to the then Arroyo-led Philippine government, and delivered the units even before a final contract was signed.

IN THE DATA:

Rodriguez appears in Commence Overseas Limited records as the beneficial owner of Skyjet International Group Limited. The company was incorporated in 2017 in the British Virgin Islands.

Skyjet looks to be used for the trade of aircrafts, as a press release from 2011 shows it sold a $18.5-million plane to Glory Key Investments Limited.

RESPONSE:

Rodriguez said the company was established for “business purposes.” As to whether the transactions he made through these companies were reported to concerned agencies is unknown.

Elmer Serrano

Elmer B. Serrano is a lawyer of the Sy family, owners of SM Prime Inc. and SM Investments Inc. The family operates the largest mall chain in the Philippines, and the country’s biggest bank in terms of assets.

Serrano sits as secretary of several Sy-owned firms, including 2GO, SM Prime Holdings, Premium Leisure Corp., and Banco dDe Oro Savings Bank.

IN THE DATA:

Serrano appears in Asiaciti Trust records as director of Myddleton Holdings Ltd., a company registered in the British Virgin Islands. He was appointed in 2018. Information on the beneficial owners or the purpose of the company are not available.

RESPONSE:

PCIJ and Rappler sent a letter to Mr. Serrano on September 16 via email. We have not received a response as of press time.

Wenceslao family

Delfin Wenceslao Jr. is president and director of real estate firm DM Wenceslao & Associates Inc. In 2003, the firm expanded to construction with the incorporation of Aseana Holdings Inc. The company has since been specializing in developing reclaimed land, with the 204-hectare Aseana City in Pasay as its flagship project.

Wenceslao Jr. passed away last September 22 at the age of 77.

IN THE DATA:

Wenceslao has appeared in Commence records as director of a British Virgin Islands company, Crown Star Ventures Limited, as early as 2001. By 2014, he included his children – Carlos Delfin, Delfin Angelo, and Edwin Michael – as co-directors of the company.

In a report by Esquire Philippines, Delfin Angelo said it was the same year the company created a “family constitution,” which detailed “the goals, concerns, rules and even dispute resolution mechanics of the family with regards to the business.” All of his sons serve on the board of DM Wenceslao & Associates Inc., with Delfin Angelo now sitting as CEO.

A 2017 document also shows Wenceslao’s wife, Sylvia Chua Wenceslao, as beneficial owner of Crown Star Ventures Limited.

RESPONSE:

PCIJ and Rappler sent a letter to DM Wenceslao & Associates Inc. on September 16 via email, but learned that he passed away on September 22.

We made follow-ups with DM Wenceslao since. We have not received a response as of press time.

Monte Oro Resources and Energy

Monte Oro Resources & Energy Inc. (MORE) is a corporation wholly owned by Apex Mining Co. Inc. Among Apex Mining’s stockholders are: Ramon Y. Sy, Walter W. Brown, Graciano P. Yumul Jr., Modesto B. Bermudez, and Dennis A. Uy.

A. Brown Company Inc. and Prime Metroline Holdings Inc. are also among Apex’s top stockholders. A. Brown is owned by Walter W. Brown. Prime Metroline is owned by Enrique K. Razon Jr.

IN THE DATA:

Monte Oro Resources & Energy Inc. (MORE) appears in Commence records as the major shareholder of Monte Oro Mining Co. Ltd., a company registered in the British Virgin Islands.

Monte Oro Mining Co. Ltd. (MOMCL) is 90% owned by Monte Oro Resources & Energy Inc. (MORE) while the remaining 10% is owned by Walter W. Brown, according to a 2017 email.

In a 2016 Commence record, Razon was indicated as the beneficial owner of MOMCL.

RESPONSE:

Billy Torres, vice president for finance and compliance officer of APEX Mining Co. Inc. confirmed that Monte Oro Mining Co. Ltd. is owned 90% by Monte Oro Resources & Energy Inc. In turn, Monte Oro Resources and Energy Inc. is owned 100% by Apex Mining Co. Ltd. (APX).

Torres said Monte Oro Mining Co. Ltd. has an exploration project in Sierra Leone, and noted “it is normal to establish offshore companies to hold offshore projects.”

Jose Carlo Antonio

Jose Carlo Antonio is managing director of listed property giant Century Properties. Prior to joining the company in 2007, he worked in the investment banking groups of Citigroup and Goldman Sachs.

IN THE DATA:

Antonio’s name appears in the list by Commence Overseas Limited as beneficial owner of Bantam Enterprises Limited, a company incorporated in British Virgin Islands in 2013.

RESPONSE:

In an email, Century Properties said that they have endorsed the queries of PCIJ and Rappler to BVI Finance. We will update this story once the company has responded to our request. – Rappler.com/PCIJ

CONTRIBUTORS TO THE ‘PANDORA PAPERS’ PROJECT: Carmela Fonbuena, Miriam Grace A. Go, Karol Ilagan, Elyssa Lopez, Pauline Macaraeg, Ralf Rivas, Felipe Salvosa

ILLUSTRATED PROFILES: Guia Abogado

Other stories in the Pandora Papers Philippines series:

No comments:

Post a Comment